Disclaimer: This article is for informational and educational purposes only. Do not interpret anything below as financial advice. Always do your own research & speak to a financial professional before making investment decisions.

Dear Subscribers,

I hope you are keeping well.

For those who didn't see my chat thread, my laptop unexpectedly shut down in April and I am yet to get a replacement. If you spot more typos than usual or feel that the quality of this write-up is somewhat compromised, please bear with me as I use my phone to get these letters out in the meantime. I must be crazy!

Not much has happened since the last update in January. In my previous letter, I focused on my intention to sell less and reduce portfolio churn as much as reasonably possible. I am pleased to report that for the first time since inception, I managed to endure the last few months without selling a single position.

Each time I release a letter, I assess those stocks purchased (or held) from the same period the year prior and make a decision about whether to continue holding the position for another year, or sell if the stock no longer passes the 'quality' filters I apply when entering a new position or making a potential exit.

In addition to reviewing the stocks already in the portfolio for potential sale, I also evaluate the Magic Formula screener to determine if any of the 50 stocks that show up are worthy of purchasing or adding to (if I already own them).

I'll begin with the stocks that were due a review for potential sale. They included Boise Cascade ($BCC), Korn Ferry ($KFY), Williams Sonoma ($WSM), and Dick's Sporting Goods ($DKS). The latter two have provided 70%+ compounded returns since I purchased them in 2022. Both continue to impress with strong metrics in line or above the hurdles I have in place.

For any new subscribers, those hurdles are:

10Y revenue growth > 0

10Y FCFPS growth > 0

FCF / earnings > 80%

10Y median ROIC > 15%

Long-term debt / FCF < 5

I will hold both until next year's review. Simple. Next, let's talk about Boise Cascade and Korn Ferry. These stocks have performed pretty well since I got into both. Boise Cascade has compounded at 46%, and Korn Ferry has returned around 6%. After passing the companies through my 'quality' stress test, I realized that both of them failed on the 10Y median ROIC filter with returns of approximately 9% for Boise Cascade and 8% for Korn Ferry.

In the past, I would have sold both of the companies for failing the tests. Yet it didn't seem fair to sell two companies that made it into the portfolio at a time when I was using a lower 10Y median ROIC hurdle rate of 8% to select which companies to purchase.

Furthermore, following the speech I gave in the last letter about not selling and engaging sloth mode at all costs, I decided to apply a different test to determine their fate: ROIIC. In a nutshell, companies that can reinvest each dollar of incremental capital at high rates (15%+) are worth hanging on to. John Huber wrote a great piece all about this topic, so I won't get into the nitty-gritty in this letter. I also wrote a piece earlier this month all about it, comparing the two companies in question if you're interested.

The results were as follows:

Boise Cascade Co

Cumulative 10Y earnings: 3088.62

Incremental capital invested: 1939.13

Incremental earnings: 431.39

Reinvestment rate: 62.78%

ROIIC: 22.25%

Value compounding rate: 13.97%

Korn Ferry

Cumulative 10Y earnings: 2029.05

Incremental capital invested: 1532.79

Incremental earnings: 112.68

Reinvestment rate: 75.54%

ROIIC: 7.35%

Value compounding rate: 5.55%

Based on the results, it is clear that Boise Cascade has effectively reinvested each dollar of incremental earnings at high rates in the last decade. The same can't be said, however, about Korn Ferry. Perhaps unsurprisingly, the value compounding rate of each company is roughly in line with their respective stock price over the last decade. Despite this, I decided to hold both of them and review in a year. The likelihood of selling Korn Ferry in that assessment has increased.

Moving on to a new purchase, I opened a position in MasterCraft Boat Holdings ($MCFT) in the most recent period. There were several other candidates for purchase, including existing holdings like 1) Buckle ($BKE), 2) Medifast ($MED), and 3) Semler Scientific ($SMLR), as well as new positions like 4) SIGA Technologies ($SIGA). A few factors influenced the decision behind the one purchase this time, including an unwillingness to over-allocate to existing large allocations (1, 2, and 3) and caution investing in healthcare (4).

MasterCraft is a leading player in the recreational boats space. The MasterCraft segment produces premium recreational performance sports boats space primarily used for water skiing, wakeboarding, wakesurfing, and recreational boating. Its Crest segment provides pontoon boats, and the Aviara segment produces luxury day boats for use in general recreational boating.

This one comes with risks for sure. Probably the most concerning is a total collapse in sales during any potential recession. One would think that discretionary items like boats are the first to avoid in tough times. With that being said, this company has a history of strong performance over the entire sales cycle. A quick peruse of QuickFS shows they have a 10Y median ROIC of 30%, 10Y double-digit growth of revenue, assets FCF and EPS with high-profit margins over 10%.

The company is net cash positive with $109m in cash and equivalents and around $47m in long-term debt. Long-term debt has decreased from over $100m in 2019. Their total debt to FCF stands at 1.06 meaning the company is not overleveraged and could pay off all their debt in just over a year's worth of free cash flow. They also announced a new $50m buyback program relatively recently in July 2023 representing 15% of the current market cap. If executed intelligently, that could seriously boost returns.

From a valuation perspective, MasterCraft is optically cheap. It trades at an FCF / EV yield of 16%. Looking ahead 5 years, even if FCF got cut in half to around $25m - you're still getting the business today for an 8% yield. Using Huber's "3 engines" approach to gauge potential forward returns we get the following bear and bull scenarios:

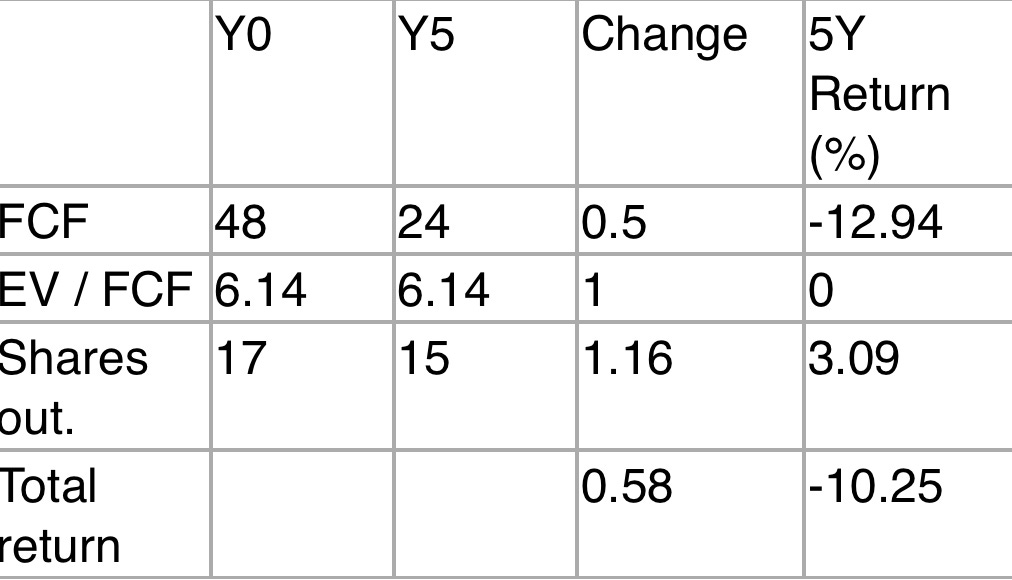

Bear case

The bear case assumes FCF gets slashed by 50%, the EV / FCF multiple doesn't re-rate, and management buys back shares at a 3% rate each year as they have been doing, resulting in a -10% return over 5 years.

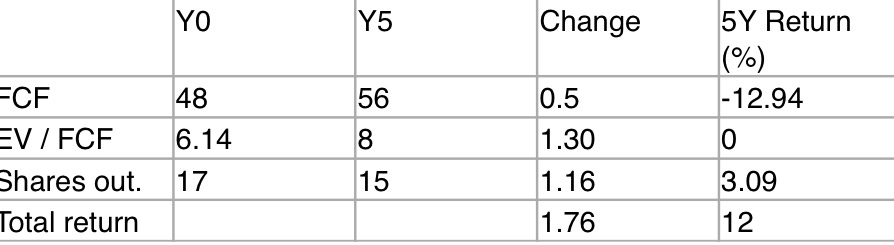

Bull case

The bull case assumes FCF grows at 3%, the valuation multiple re-rates to 8x and the share count drops by 11.7% (3% each year) resulting in a 12% return. This seems like a classic heads I win tails I don't lose much scenario but it isn't without risk. That said, if management decides to ramp up the buybacks, FCF chugs along, and the multiple re-rates like crazy then the returns would be more than satisfactory.

That's it for today. I hope you enjoyed this write-up. Please let me know what you think about the new purchase in the comments section below.

Thanks as always for reading. I’d appreciate it greatly if you shared the newsletter with anyone you think would find it interesting.

QC