Disclaimer: This article is for informational and educational purposes only. Do not interpret anything below as financial advice. Always do your own research & speak to a financial professional before making investment decisions.

Dear Subscriber,

Time for another Magic Formula update.

In this letter, I discuss portfolio activity since my last update in April. For any new subscribers, hello and thank you for stopping by.

I’m a Magic Formula guy who decided to put Joel Greenblatt’s strategy to the test in 2021. The objective is to outperform the major indices over a 5-10 year period.

Every few months, I purchase a selection of stocks based on a series of ‘quality’ filters I’ve defined. Feel free to check out my previous letters for more on those.

If stocks on the screen don’t pass the filters, I don’t purchase them. Otherwise, I rank them against what’s already in the portfolio and decide what action to take.

Since I’m not adding any more capital to the portfolio, adding new positions means selling existing ones. Something I try to avoid where possible.

I hold stocks for at least one year periods before reviewing them again. I then decide whether to hold, sell or add more based on my ‘quality’ selection criteria.

Here’s an approximate idea of purchase timings in a given year:

Batch 1: November-December

Batch 2: January-February

Batch 3: April-May

Batch 4: July-August

I’m quite flexible with the above and it changes depending on how busy I am at the time.

Here’s a snapshot of how things are looking performance wise as of 31/07/2024:

Investments: 16

Performance since inception: 3.90% vs. 8.89% (S&P 500)

Performance this financial year: 4.20% vs. 19.26% (S&P 500)

Per my last portfolio page update on 27/04/2024, there was a delta of 6.98% between the Magic Formula portfolio and the S&P 500 since inception in 2021.

That delta has been reduced to 4.99% per the above performance snapshot. Much less when compared to a global index (~2%).

This is brilliant to see, since the strategy has evolved a great deal since 2021. I made several tweaks to my selection criteria which probably didn’t help performance either.

For reference, had I bought the 16 companies I currently own and simply held on to them, they would have returned 21.94% CAGR since inception.

Hindsight is a wonderful thing. Let’s review Batch 4.

Buckle up!

Between April and August, activity was relatively minimal. I decided to plow any cash I received from dividends back into Buckle (BKE) - my largest holding.

Rather than deploying the cash into a new holding, that would occupy a tiny percentage of the portfolio, reinvesting back into Buckle seemed logical. Why?

Until recently, the company traded at a juicy 12%-15% FCF/EV yield and has a strong operating history dating back decades.

It also pays out pretty much all of its earnings to shareholders via a dividend and special dividend.

I’ve tweeted about my thoughts on Buckle as a compelling investment case on X a few times. With a 12% cash yield being paid out as a dividend, investors don’t need to ask for much growth for a handsome return.

Assuming a 3% long term return that gets you to 15% quite easily. Any multiple expansion on top of that is just added benefit.

Since I started buying Buckle shares in early 2022, the stock has done about 24% compounded: 19% from capital appreciation and 5% from dividends.

The stock has raced up to ~$43 in recent days, reducing its FCF/EV yield to 9.74%, just under my buy range of 10%+.

I also sold out of Semler Scientific (SMLR) during the period, after the company announced it’s bitcoin treasury strategy.

As a value guy, I’m not too interested in companies that raise money to buy cryptocurrencies. Particularly ones in a far from ideal financial position.

Existing holdings

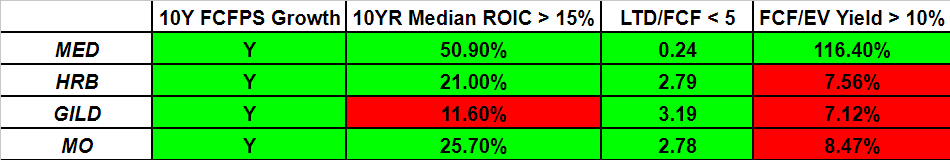

The companies assessed for hold/sale decisions during this period were: Medifast (MED), H&R Block (HRB), Gilead Sciences (GILD) and Altria Group (MO).

I sold out of GILD entirely and held on to MO, HRB and MED. While MED presented an opportunity to add more, the position is already down ~66%. I am also reasonably exposed already.

If it turns out to be a multibagger, then now is the time to scoop up cheap shares but I chose to exercise caution in this scenario given my exposure and the controversial nature of their MLM marketing strategy.

Source: quantcompounding material

New holdings

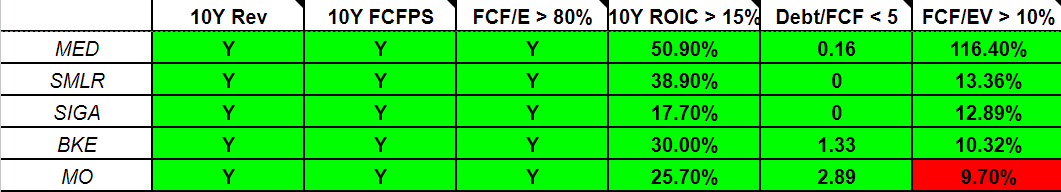

Using the proceeds from the GILD sale, I initiated a new position in SIGA Technologies (SIGA). Avid readers of my letters will know that this is a position I’ve owned in the past and subsequently sold.

Given the flawless ‘quality’ metrics, as well as the other ‘winner’ companies in the screen (MED, SMLR, BKE) out of the question for reasons explained, I decided to initiate a new position in SIGA.

Source: quantcompounding material

Final remarks

We’re making progress. The performance gap is closing against the index and slowly but surely we’re whittling down the number of portfolio holdings to what feels like a more manageable number.

Ideally, we’ll end up with around 10-12 holdings. I believe this is possible, given that some of the holdings due for review in the next letter (Robert Half Inc and Ocuphire Pharma Inc) don’t fit the evolved quality filters I’m now applying to make purchase, hold and sell decisions.

Keep your eyes out for my next letter in November 2024. It is crazy to think that it will mark 3 years of this Magic Formula experiment.

Big thanks to you for continuing to read the newsletter. I read all the comments and enjoy engaging with you either on Substack or X.

Until next time,

QC

Koyfin Discount

I’m not one to promote products I don’t use personally.

Koyfin lets you pull all the metrics discussed on the newsletter including FCF/EV yield and years worth of financial data.

By using this link you can enjoy a 10% discount to Koyfin’s Plus and Pro plans.

It also helps support this publication’s growth!