Disclaimer: This article is for informational and educational purposes only. Do not interpret anything below as financial advice. Always do your own research & speak to a financial professional before making investment decisions.

Welcome to the Q2 edition of the Quant Compounding Magic Formula Newsletter.

I recently listened to an interesting podcast episode that talked about how AI is and will continue to change the way online bloggers and newsletter writers produce content.

The speaker, Nick Maggiulli (author of “Just Keep Buying”), suggested that AI alreadys generates content better than 90% of what’s out there and as a result spurred a shift in the way he approaches blog writing.

Nick says that these days he only puts out blogs that have significant personal meaning or symbolism that an AI agent simply can’t recreate (for now?!). This has resulted in a lower cadence of publications but arguably it has improved the overall quality of Nick’s content as, one would assume, each post gets heavily vetted before being released into the investing universe.

Why am I saying all this?

Nick’s words really resonated with me and it seems apparent that a lot of finance and investing content I’ve read recently tends to regurgitate a plethora of funky formulas, quotes from Warren Buffett, and as Nick would probably argue, not add significant value.

Don’t get me wrong there’s a lot of great content out there too, but I think being mindful of this idea is important, particularly given the rise of AI and the ease to ask an AI agent to generate a quick post in a matter of seconds.

I have certainly been guilty of using AI for things like grammar, punctuation, and perhaps some occasional inspiration in my writing, and would argue that for such tasks it provides some great value.

Nevertheless, moving forward I would like to try to provide something useful to you all rather than a systematic update of my portfolio’s performance and a couple of forecasts. I am also planning to share performance results bi-annually effective this post.

2025 Half Year Results, as of 28th June 2025

Investments: 2

Since first purchase: 1.63% (MF) vs. 7.76% (S&P 500)

YTD: -8.80% vs. -6.32%

Readers of the newsletter will know that I made a decision in the last year to bet big on my best ideas for the remainder of the 5Y experiment I embarked on in November 2021 to put the Magic Formula to the test.

While I’ve not followed the strategy Greenblatt laid out in the book, there is one thing I can say I’ve done consistently since I launched the newsletter: invest in stocks that appeared on the Magic Formula screener.

The experiment officially comes to a close in November 2026 and I decided to cut the fluff and swing big on two businesses which I believe have immense potential: Ituran Location and Control (ITRN) and Crocs, Inc. (CROX).

For those interested in a wonderful write up about Ituran, I highly suggest you read the following article by Silba, which does a far better job that I could do detailing the bull thesis.

In today’s newsletter, I would like to share my key takeaways of said post:

Ituran monetises insecurity with utility-like precision. The business has transformed fear, specifically, the fear of car theft, into a predictable, high'-margin subscription business.

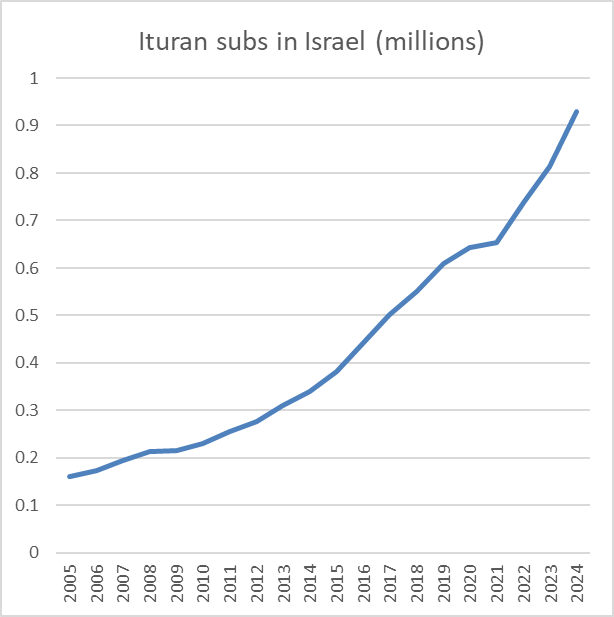

Geographical arbitrage. Ituran extracts value in environments where public safety breaks down and institutions fail. Their strongest markets, Israel and Brazil, are ones where the state mandates tracking (Israel) or crime makes it indispensable (Brazil). In effect, Ituran profits from government incapacity, with insurers and banks subsidising their service as a workaround to societal failures.

Ituran is a business with powerful operating leverage. The market still values the business like a traditional utility (EV/FCF of 11x), ignoring its transformation into a scale-driven, subscription-based growth company with 58.7% gross margins and fixed costs largely in place.

Family-run business offers strengths and risks. The Sheratzky family’s long-term operational control has enabled strategic consistency and capital discipline, avoiding the pitfalls of overexpansion and dilution.

Ituran’s moat relies on friction and embeddedness, not tech. Ituran’s real competitive edge isn’t just its tracking technology—it’s the hard-to-replicate ecosystem around it. Insurance mandates, certified installer requirements, and deeply embedded recovery teams in high-crime areas create high switching costs and operational know-how that new competitors can’t easily match.

In my mind, the bear thesis revolves around the following concepts:

The Ituran Legacy: While skin in the game is something we love to see as value investors, is there such thing as “too much”? In Ituran’s case, Silba points out that three generations of Sheratzkys occupy executive positions. The author argues that this is part of a carefully crafted plan, however, I spotted comments suggesting that with billions of people in the world, what are the chances that the sons of the founder are the best choices to run the company? Also, it can be argued that looming succession risks (with the founder nearing 80) introduce potential instability.

Resilience of Ituran’s moat: We have seen that Ituran’s moat is highly resilient. Yet this moat is double-edged: it makes Ituran indispensable in legacy systems but vulnerable to disruption when those systems are rebuilt or leapfrogged (e.g., post-2G tech transition).

Market ignorance: While the company seems to have proven that it has all the characteristics of a high-margin SaaS business, the market continues to price the company like a utility dividend payer. There is always the risk that this continues to be the case, and the market does not reward the company with the premium multiple it serves. That said, one could also argue that it provides a better opportunity to scoop up cheap shares and maximise returns over the long run.

The moral dilemma: Ituran thrives in environments where public safety breaks down. As we have seen, this strategic geographic targeting creates high switching costs and a strong moat, but undoubtedly raises some uncomfortable ethical questions that investors need to consider before initiating a position in the business.

It is apparent that I am more convinced in the bull thesis given my position in Ituran. I also think that given the current EV/FCF Yield is c. 9%, this offers a decent margin of safety. Historically the business has opted for dividends, with a current dividend yield of 5.6% and a payout ratio of 75%.

Assuming the business manages to reinvest the remaining 25% at a 25%-30% ROIC, we can assume a 6%-7.5% growth rate moving forward. In other words, given the current yield, the business offers a compelling 15%-16.5% return profile, which interestingly is the return the business has generated for me to date.

I look forward to connecting again in Q3 and hope you enjoyed this half year edition of the newsletter.

QC