Disclaimer: This article is for informational and educational purposes only. Do not interpret anything below as financial advice. Always do your own research & speak to a financial professional before making investment decisions.

Fellow Quant Enthusiasts,

Welcome back! Time for another Magic Formula update. Let's jump right in.

Performance since inception: -10.49% vs. -7.84% S&P 500

Performance this financial year: 3.41% vs. 3.65% S&P 500

For any new readers out there I set myself a goal in November 2021 to implement the Magic Formula for 5 years - the investing strategy popularised in "The Little Book That Beats The Market" by Joel Greenblatt.

I wanted to document the progress every few months to hold myself accountable for committing to the strategy and finding out for myself if it could beat a major market index like the S&P 500 Greenblatt claims is possible given the appropriate time frame.

Straightforward enough right?

Well it turns out that this strategy comes with a whole host of complications. Before going any further I wanted to share some examples for anyone who is thinking of implementing this strategy for themselves:

1. Churn

This strategy encourages you to sell positions annually (unless they reappear on the screen - at which point the investor must decide whether to hold or sell) meaning the benefits of "long-term compounding" over many years cannot be enjoyed.

2. Purchase decisions

Greenblatt's website MagicFormulaInvesting.com is great for the initial screen of 30-50 stocks after which point it is up to the individual investor to decide how to arrive at 5-7 positions when purchasing new stocks.

3. Rebalancing

While not impossible, the art of rebalancing the portfolio has proved somewhat challenging due to swings in performance of different positions. Having enough cash on hand is important to accommodate for non-performers.

Process

Navigating these issues I've learnt a LOT about myself as an investor.

I've realised that psychologically I'm much more suited to the long-term "set and forget" mindset - something this strategy disregards due to its high churn nature.

Consequently, while not totally useless, I've realised that the filters I've implemented up until this point to optimise purchase decisions e.g. 10Y FCF growth and 10Y ROIC above 10% are more suited to “long-term compounders” rather than stocks with a high likelihood of appreciating in the next 12 months.

If you think about the main drivers of stock price appreciation in the long term it really boils down to: 1) earnings growth 2) dividends 3) share buybacks and 4) multiple expansion. Rightly or wrongly I've concluded that earnings growth is harder to predict in the short term and while share share buybacks are great, their effect on price change is slow at the start and faster later given constant equity value.

Pivot?

The high churn nature of the Magic Formula has forced me to think about other ways in which I can generate more stable returns for the portfolio. Selecting stocks with a long history of paying and increasing dividends will provide a reliable stream of income to the portfolio which can then be reallocated into other interesting opportunities when purchasing new rounds of Magic Formula stocks. Since these stocks will also be statistically "cheap" I’ll be able to scoop up more shares at cheaper valuations, benefit from a higher dividend yields and increase the probability of multiple expansion and reversion to the mean during the 12 months holding period.

As a value investor I find it challenging to predict what earnings are going to do in the next 12 years let alone 12 months and since the value generative effect of buybacks is difficult to realise in such a short time frame I've decided to start focusing on stocks with a cheap valuation multiple and a long track record of growing dividends for the remainder of this 5 year experiment.

This may well turn out to be a poor decision but I can't justify anymore selecting stocks based on metrics that I usually use for positions I plan to hold for 5+ years.

Below I outline the adapted approach I took to select the stocks for Year 2, Batch 2:

Step 1

I removed companies from the screen that I own that are not eligible to be sold in the current round i.e. they have not been held for at least 12 months in the portfolio (HPQ - Year 2, Batch 1, ITOS - Year 1, Batch 3, KFY - Year 1, Batch 3, MED Year 1, Batch 4).

Step 2

I kept companies on the screen that I own that are eligible to be sold in the current round i.e. they have been held for at least 12 months in the portfolio (BKE - Year 1, Batch 2).

Step 3

I ensured all companies from the screen pay a dividend.

Step 4

I marked companies that have grown their dividends over 10 years.

Step 5

I ranked companies that have grown their dividends over 10 years by EV/EBIT.

Year 2, Batch 2 Stock picks

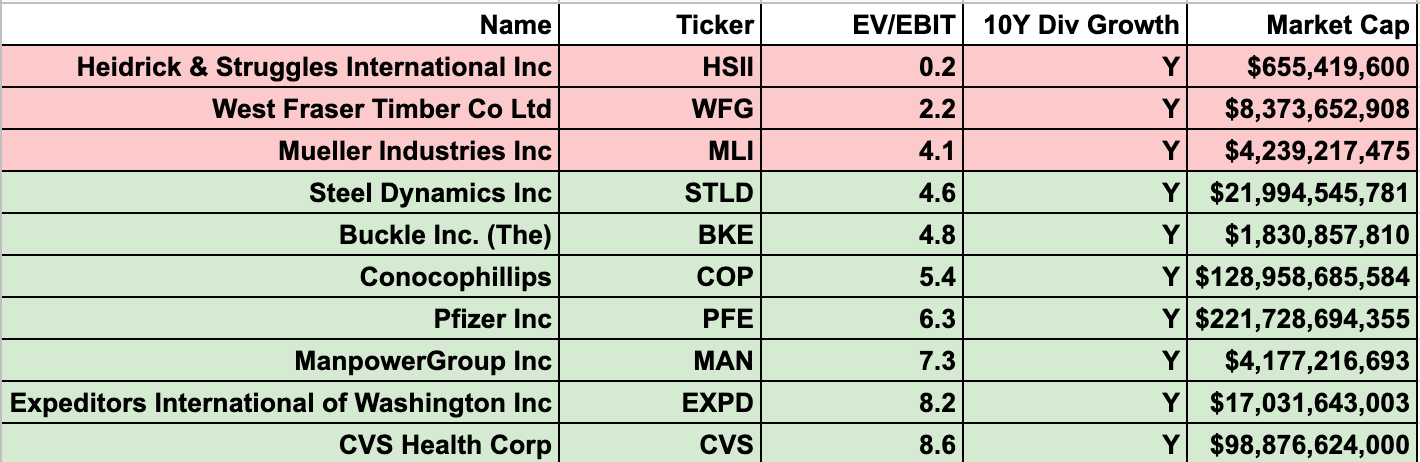

This approach resulted in the following 7 companies after replacing the initial winners - Heidrick & Struggles International, Inc. (HSII), West Fraser Timber Co. Ltd. (WFG) and Mueller Industries Inc (MLI) - since they were unavailable on my brokerage platform:

Source: QuantCompounder Research

When compared to the stocks I bought just a round ago (Year 2, Batch 1) the most obvious difference is in market cap. This round of picks included 2 Mid Caps (BKE, MAN), 4 Large Caps (STLD, COP, EXPD, CVS) and 1 Mega Cap (PFE) compared to 1 Small Cap (SIGA), 4 Mid Caps (OGN, HCC, RHI, THO) and 1 Large Cap (HPQ) in the previous round.

This is expected given the shift in strategy since larger and more mature companies often have less capacity to invest free cash flow into growth and instead distribute whatever cannot be reinvested back into the business to shareholders via dividends.

"The first rule of compounding: Never interrupt it unnecessarily." - Charlie Munger

Outlook

I'm certainly not naive enough to assume that companies of this size are going to deliver 100x multibagger returns. In fact, I'm a huge advocate for small and micro cap investing for investors seeking outperformance since these companies are typically illiquid, underfollowed and mispriced. However, as Charlie Munger says "The first rule of compounding: Never interrupt it unnecessarily".

Unfortunately given the nature of the Magic Formula strategy interrupting the magic of compounding is precisely what is happening. That said I believe reliable returns will be generated in the portfolio through a consistent stream of growing dividend income and through multiple expansion where stock valuations revert to the mean.

This experiment continues to reveal my tendencies as an investor as well as the merits/flaws of the Magic Formula.

I look forward to sharing an update next round. Until then please feel free as always to leave any comments in the section below or join my chat.

All the best,

Quant Compounder

QuantCompounder Koyfin Discount

I’m not one to promote products I don’t personally use. Koyfin is a brilliant tool built by investors that provides access live market data and powerful analytical tools so you can analyse companies and see the data you want to see, how you want to see it.

By using this link you can enjoy a 10% discount to Koyfin’s Plus and Pro plans if you’re interested. It also helps support this publication’s growth.