Disclaimer: This article is for informational and educational purposes only. Do not interpret anything below as financial advice. Always do your own research & speak to a financial professional before making investment decisions.

Fellow Quant Enthuasiats,

I hope you are all keeping well.

Welcome to another instalment of Magic Formula stock picks. November is always significant for me as it is the month I started this experiment back in 2021.

Two years later and we’re entering the third year strong as ever.

Let’s dive right in with a portfolio snapshot as of today:

Investments: 21

Dividend yield: 3.06%

Performance since inception: -8.38% vs. 0.03% S&P 500

Performance this financial year: 3.95% vs. 16.02% S&P 500

Our objective here at QuantCompounding is simple. To put Joel Greenblatt’s Magic Formula to the test. Over decades. But there’s a catch. Rather than following the formula to a T, I add some unique filters that I believe optimise for business quality that the formula on its own does not account for.

Those filters are inspired by what John Huber refers to as “The 3 Engines of Value” and include the earnings on a per share basis, some kind of multiple expansion and the shares outstanding. The product of those three factors, as Huber puts it, will always equal the return of any given equity.

For those interested in Huber’s “3 Engines” approach, there’s a brilliant post on his Substack, Base Hit Investing.

With that in mind, below I recap the filters I apply (in order) when whittling down Greenblatt’s original screen of 30 stocks over on magicformulainvesting.com. Note: I always start with 30 stocks rather than 50.

Filters

For those new around here, I use the below filters to sift through Greenblatt’s screen and make purchase decisions:

10-Year Free Cash Flow Per Share Growth (must have increased)

10-Year Median ROIC (must be above 15%)

Long Term Debt / Free Cash Flow (must be below 5)

Free Cash Flow / Enterprise Value (must be above 10%)

I use whatever capital has built up either from dividends or personal contributions and divide that number by however many stocks pass the filters to decide how much to allocate to each one. For example, let’s imagine $1000 dollars had built up between Batch 1 and Batch 2 and five stocks passed the below criteria.

In the above example, I would simply allocate $200 to each position (existing or new) provided they passed each criteria. If an existing holding that is due for sale consideration (i.e. held for at least one full year) passes the first three filters but doesn’t pass the fourth filter (valuation) I do not buy more or sell. I simply hold.

Conversely, if an existing holding that is due for sale consideration fails any of the first three filters, it’s out. No questions asked. Instant sale.

Divid-end

Avid readers of the newsletter will notice that I removed the “Dividend Streak” filter from the last letter. While the goal remains to reduce the filter modifications between letters, I removed this filter for two reasons.

First and foremost, dividends are tax inefficient and since I am in the early stages of my investing lifecycle I would much rather have management either a) reinvest profits back into the business at high returns b) buy back shares c) make acquisitions or d) pay down debt.

Second, while it is true that dividends can contribute to overall return, by specifically filtering for companies that have increased their dividend by at least three consecutive years, I was automatically removing companies with huge potential to deliver shareholder value in the ways described above.

Perhaps during retirement the filter would be suitable but I realised that we are after one thing on this newsletter: returns. And returns can come a combination of the 3 Engines + dividends. Notice how dividends are an additional luxury?

Let’s take a look at the activity from the last quarter:

Existing Tickers

The below tickers represent the ones that were due for sale consideration this quarter since I purchased them in November 2022.

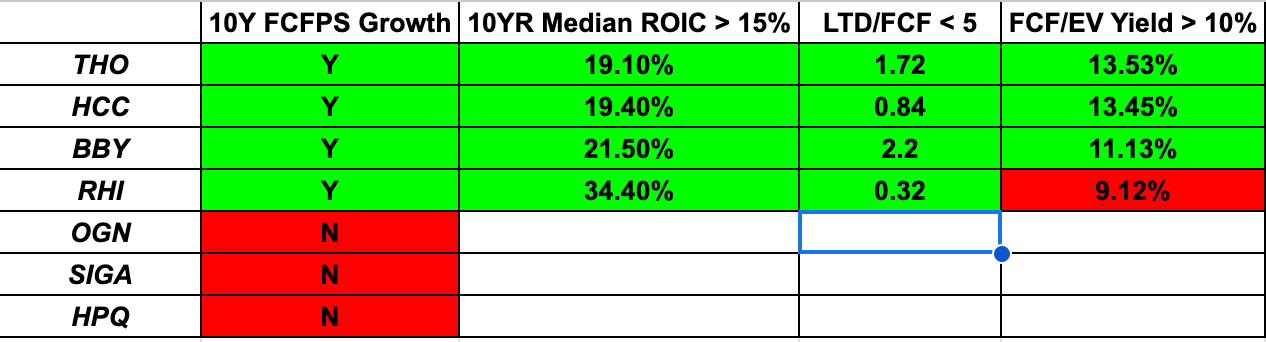

As the table shows, I sold out of Organon & Co (ORG), SIGA Technologies (SIGA) and HP (HPQ) completely since they all failed my first filter, each with decreasing Free Cash Flow over the last 10 years.

I added to Thor Industries (THO), Warrior Met Coal (HCC) and Best Buy (BBY) who passed all four filters with flying colours.

I held on to my position in Robert Half as the valuation wasn’t a screaming buy, with a FCF / EV Yield below 10%.

Source: QuantCompounder Material

New Tickers

The table below shows the new tickers that came out on top after my filters had been applied to the most recent screen. As you can see, a few existing holdings cropped up again.

I started new positions in Ocuphire Pharma (OCUP) and Semler Scientific (SMLR). I ended up adding to my positions in Medifast (MED), Buckle (BKE) and Altria (MO) since MasterCraft Boat (MCFT) was unavailable through my broker (sigh).

Source: QuantCompounder Material

Activity summary

Sold out of…

Organon & Co - 1 year holding period. -53.40% return

SIGA Technologies - 1 year holding period. -44.23% return

HP - 2 year holding period. -5.96% return

Held on to…

Robert Half

Added to…

Thor Industries

Warrier Met Coal

Best Buy

Medifast

Buckle

Altria

New positions

Ocuphire Pharma

Semler Scientific

Final thoughts

All in all I am pretty satisifed with how the portfolio is shaping up. Over the last two years I’ve learnt a lot about myself as an investor and the filters, although simple, speak for themselves: I’m looking for companies that can: a) grow their cash flows over time at b) consistently high rates of return with c) minimal debt at d) an attractive valuation.

As far as the boiling down the basics to four simple filters which can be applied systematically to the formula laid out in Greenblatt’s book - I think we have a decent recipe for future success. Now we just need to keep pushing.

Would love to hear your feedback either in the comments or my Substack chat which you can access by downloading the app. You can also find me on Twitter.

QC

QuantCompounder Koyfin Discount

I’m not one to promote products I don’t personally use. But, as I mentioned in the write-up, I loved using Koyfin to pull all the metrics discussed today including dividend streaks, FCF/EV yield and years worth of financial data I’ve struggled to find elsewhere.

By using this link you can enjoy a 10% discount to Koyfin’s Plus and Pro plans if you’re interested. It also helps support this publication’s growth.

why not open an IBKR account and buy every company that fit criteria